Globalists Push For More Dictator Powers

Emmanuel Macron stood in front of cameras in India this week and said something that would have gotten him laughed out of any American political conversation. He called free speech “pure bullshit.” Not hate speech. Not misinformation. Not some narrow category of dangerous content. Free speech itself. The foundational principle of Western civilization. The right […]

MAGA Win! We’ve All Been Waiting For This

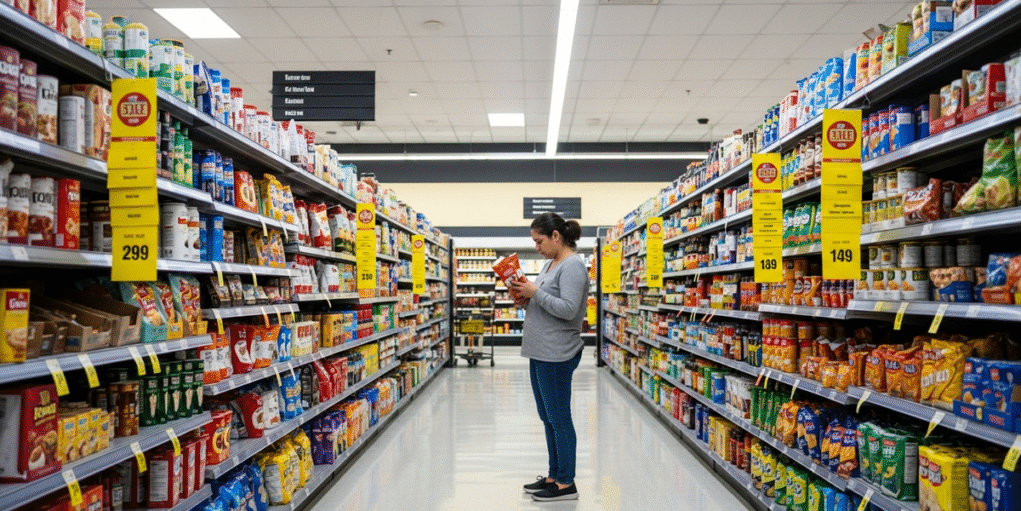

Remember when every economist with a cable news contract told you that Trump’s tariffs would send prices through the roof? That your grocery bill would double? That inflation was about to come roaring back the moment tariffs hit? The companies that actually set prices just filed their answer. And it’s not what the doomsayers predicted. […]

Democrats Demand “Sanctuary Locations” At Polls

There’s a rule in politics: when someone tells you who they are, believe them. Democrats just told us something very interesting, and they didn’t even realize they were doing it. While threatening to shut down the government over DHS funding — again — Senate Democrats released their wish list of demands. Judicial warrants instead of […]

“Arctic Sentry” Operation Launched, Trump Eyes Takeover

Remember when the entire media class spent weeks mocking Trump for wanting to buy Greenland? Remember the hot takes, the late-night jokes, the editorial board condescension? “He thinks you can just buy countries!” they howled, wiping tears of laughter from their eyes while completely missing the point. Nobody’s laughing now. NATO just launched “Arctic Sentry” […]

Mexican Cartel Drones Target America

Here’s your Wednesday morning headline that should’ve led every newscast in America but didn’t: Mexican cartel drones penetrated U.S. airspace over El Paso, the Department of War disabled them, and the FAA shut down all flights over the city under a deadly-force authorization. Read that again. Deadly force. Over a U.S. city. Because drug cartels […]

Democrats Freak Out Over New Fundraising Numbers

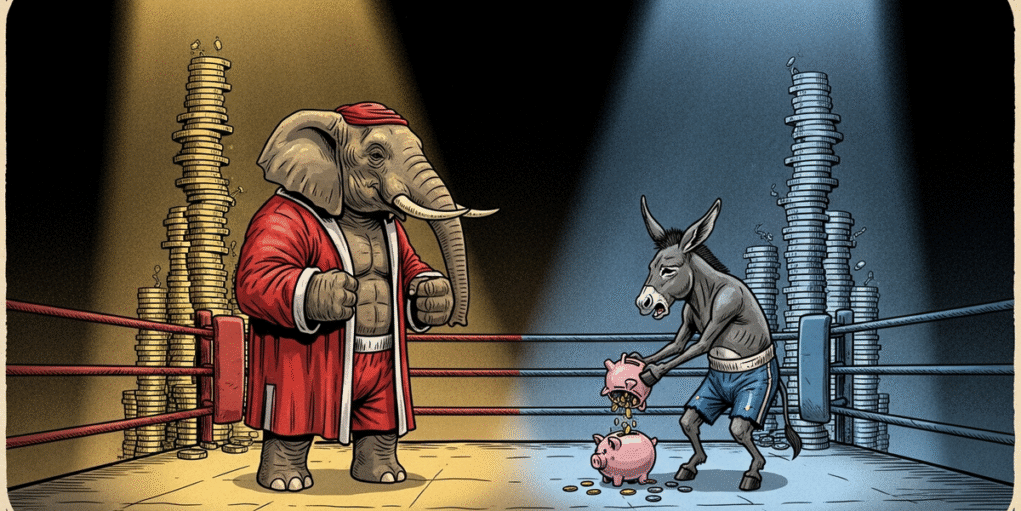

There’s a special kind of panic that hits a political party when their own strategists start borrowing punchlines from Jay-Z to describe the opposition. That’s where Democrats find themselves right now — staring down a fundraising gap so wide you could drive a fleet of Trump Force One jets through it. The numbers are brutal. […]

Trump Responds To Olympic Skier Who Disrespected America

Imagine this. You’ve trained your entire life for one moment. You’ve made the United States Olympic Team. You’re in Milan, representing the greatest country on Earth on the world’s biggest athletic stage. And your first instinct is to grab a microphone and complain about how hard it is to wear the American flag. Meet Hunter […]

Bill Gates Could Lose Everything

There’s a moment in every scandal where the walls start closing in. It’s not the first accusation. It’s not the investigation. It’s when the people closest to you stop defending you and start pointing at you instead. Bill Gates just hit that moment. And her name is Melinda. The Department of Justice dropped three million […]

Trump Just Fundamentally Changed America’s Economy

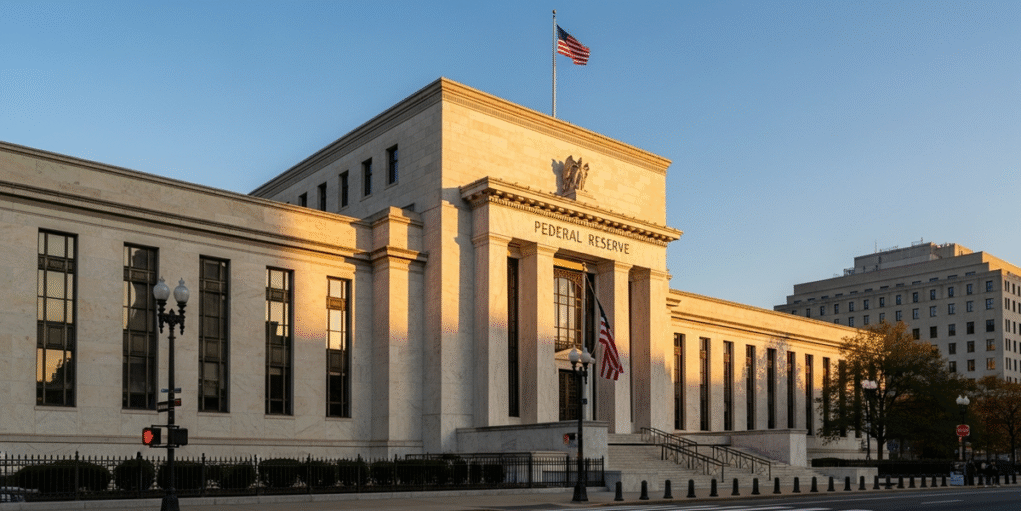

Jerome Powell ran the Federal Reserve for eight years. During that time, inflation hit 40-year highs. Interest rates whipsawed from near-zero to levels that crushed homebuyers. The Fed’s balance sheet ballooned to $6.6 trillion. And the central bank spent time and resources joining global climate change groups, implementing ESG frameworks, and pursuing DEI initiatives. In […]

Dems Attack ICE Agents With Life-Threatening Demands

Let’s be very clear about what Democrats are demanding in exchange for funding the Department of Homeland Security. They want ICE agents to remove their masks. They want ICE agents to wear personally identifiable information on their uniforms. They want this in an environment where death threats against agents have increased 8,000%. That’s not a […]

Covid Tyranny Continues As A Shadow Policy

Pete Hegseth has done good work at the Department of War. DEI offices shuttered. Transgender mandates rescinded. The radical social engineering that infected our military under Lloyd Austin is being dismantled. But there’s a massive failure that nobody’s talking about. The service members who were discharged for refusing the COVID vaccine — patriots who stood […]

Schumer Laughs While Holding America Hostage

Democrats are holding the government hostage. Their demand? Cripple ICE. Chuck Schumer announced Wednesday that Democrats won’t support the DHS funding bill unless three “reforms” are implemented. He called them “common-sense and necessary policy goals.” They’re neither. They’re designed to make immigration enforcement impossible. And if Republicans don’t comply? Partial government shutdown starting January 31st. […]

Christian Children Held Captive In America

“Daddy, I thought you were going to die.” That’s what a child told his father after the mob left Cities Church in St. Paul. The family had been surrounded in their car. Prevented from leaving. Terrorized during what was supposed to be Sunday worship. The details emerging from witness statements are horrifying. This wasn’t protest. […]

America’s New Super-Advanced Weapon

“The Discombobulator.” That’s what President Trump calls it. And apparently, it’s the reason Nicolas Maduro is sitting in a Brooklyn jail cell instead of ruling Venezuela. The Revelation Trump sat down with the New York Post in the Oval Office and dropped a bombshell that sounds like something out of a Tom Clancy novel. During […]

Assassination Culture Rising – With Surprising Supporters

We’ve had two assassination attempts on Donald Trump. Charlie Kirk was gunned down at a speaking event. A CEO was executed on a Manhattan sidewalk. And somehow, a chunk of America looked at all of it and said, “Yeah, that’s fine.” Welcome to assassination culture. It’s real. It’s growing. And the people driving it aren’t […]

Most Popular

Most Popular